In pursuing effective corporate governance, KGI securities Co. Ltd. (“KGI”) insists in transparent operation and focuses on long-term development and sustainable business, Believing strongly that a robust and efficient board of directors (“BOD”) is the cornerstone for excellent corporate governance, it is therefore KGI sets up “Audit Committee”, ”Compensation Committee” , ”Risk Management Committee” and ”Sustainable Development & Ethical Corporate Management Committee” under its BOD with the expectation to achieve the professionalism and independence of the BOD’s supervisory function and to uphold the spirit of corporate governance. In addition, various committees, such as ”Credit and Originating Pricing Committee”, ”Trust Asset Assessment Committee”, ”New Product Review Committee” and ”Brokerage Business Credit Committee” are also established to safeguard the rights and interests of shareholders and investors. The roles and responsibilities of these committees are as follows:

- Audit Committee: to exercise powers of supervisors as specified under applicable laws, and to oversee a) the fair expression of financial statements; b) the effective implementation of internal control systems, regulatory compliance and risk controls; and c) the appointment/discharge of attesting certified public accountants and their independence as well as their performance.

- Compensation Committee: to review and advise on the performance evaluation of KGI’s directors and officers as well as the policy, structure, standard and composition of their remuneration.

- Risk Management Committee: to plan and supervise risk management matters.

- Sustainable Development & Ethical Corporate Management Committee: to manage the practice of sustainable development, push forward corporate government, pay attention to sound ethical corporate management and development about the related risk and opportunity of climate retardation and adaptation measures.

- Credit and Originating Pricing Committee: to review underwriting and investment deals.

- Trust Asset Assessment Committee: to assess the use and status of trust assets entrusted by KGI’s clients.

- New Product Review Committee: to conduct pre-launch review on products distributed or brokered by KGI or new business/financial products to be undertaken by KGI.

- Brokerage Business Credit Committee: to plan and supervise brokerage related financing and lending/borrowing business.

In addition, Audit Department will ensure the completeness of internal control system and conduct internal audit on the front, middle and back offices for full compliance of relevant operation requirements. Each business unit will convene regular or ad-hoc meetings and keep close contact with the management so as to make sure relevant issues have been fully discussed prior to the decision, a practice of corporate governance in daily operations.

- Fully comply with the laws and regulations governing information disclosure by timely providing information about the company’s finance, business and corporate governance to investors though Market Observation Post System and KGI’s official website so as to ensure the information disclosure and transparency..

- Establish adequate risk control mechanism and firewall to uphold rights and interests of the investors by enacting internal rules such as “Procedures Governing Loan of Funds and Making of Endorsement/Guarantees”, ”Procedures Governing Acquisition and Disposal of Assets”, “Operational Guidelines on Subsidiary Supervision” “Regulations Governing the Handling of Whistle Blowing Cases on Illegal and Unethical or Dishonest Conduct” and ”Code of Conducts”.

- Set up a management team of professional managers to promote business operation and enhance shareholder protection in a fair, objective and competent manner.

- Currently KGI’s BOD consists of eight directors with various backgrounds from finance, industry and academia, all having extensive experience in business management and sufficient knowledge, skills and integrity. Among them, three are independent directors. KGI informs directors of regulations relating to corporate governance as soon as they assume their post, and updates them of any changes. In order to assist directors in performing their duties, KGI also furnishes directors with information about advanced education programs and arrange the relevant programs for them.

- The BOD meeting is convened on a monthly basis, but it can be convened anytime if there is any urgent matter. The head of internal audit department shall attend the BOD meetings to present their audit reports and the audit department hold annual discussion conference for the reviews on deficiency of the internal control system in accordance with Section 4 of Article 3 and Article 35 of Corporate Governance Best-Practice Principles for Securities Firms. The head of financial department shall attend the BOD meetings to report on financial status and profits. In reviewing financial reports, the certificated public accountants will be invited to attend the BOD meetings for further explanations. During business days other than the date of BOD meetings, the directors may discuss and communicate with the said department heads or certificated public accountants if they deem it necessary. Office of Company Secretary will arrange BOD meetings and assist in consolidating proposals in advance. All members of BOD will be notified prior to the meeting of the time, agenda and materials of BOD meeting, in accordance with relevant laws and regulations.

-

KGI has appointed a chief corporate governance officer as of 1 May 2019 pursuant to relevant regulations. The BOD also approved to set up a “Standard Operation Procedure for Handling the Requests by Directors” so as to assist the directors in performing their duties and to increase the BOD’s efficiency.

-

If in a BOD proposal, any director has personal interests which may be likely to jeopardize KGI’s interest, such director shall abstain from participating and voting in said proposal to avoid conflict of interests.

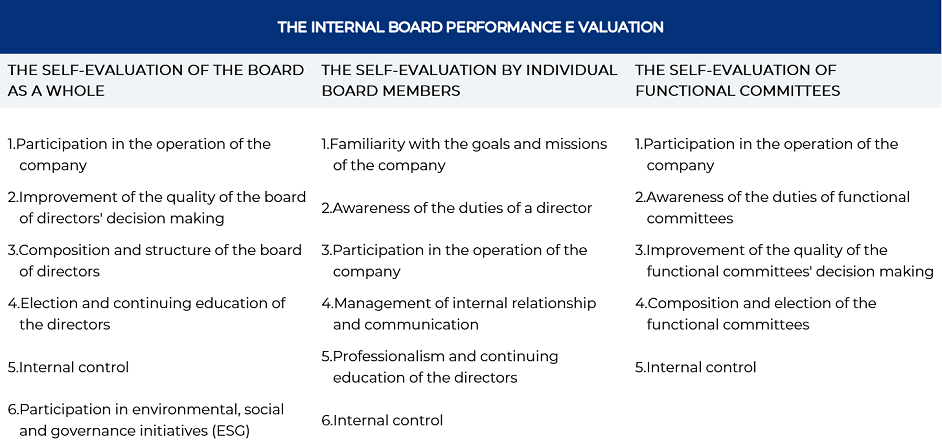

In order to implement corporate governance and enhance the functions of the BoD, KGI Securities establishes performance targets to enhance the operational efficiency of the BoD. In order to comply with the Company’s “Principles for the Performance Evaluation of the Board of Directors,” KGI Securities conduct the internal performance evaluation of Board’s performance once a year. The scope of the evaluation includes the Board as a whole, individual Board members, and functional committees. The results of the internal Board performance evaluation for Year 2025 are summarize as follows.

Note: Five levels for each index: Excellent (5), Good (4), Fair (3), Acceptable (2), and Needs Improvement (1). The scoring standard is based on the “average score”

- KGI thinks highly of the rights and interests of its employees and diligently complies with Labor Standards Act and relevant laws and regulations. In addition to the implementations of menstruation leave, family care leave, and other measures to protect equality in employment in accordance with Act of Gender Equality in Employment and relevant labor related regulations, KGI also furnishes email box for employees to provide their survey/suggestions and enacts preventive measures to anti-sexual harassment, both of which are handled and processed confidentially by specially-assigned persons.

- KGI carries out performance evaluation of employees in an objective and fair manner; establishes complete educational training and development system to demonstrate the equal importance on professional knowledge and work duties; and creates diverse and high-quality learning environment for employees. To provide employees with immediate support and care, KGI also offers compensations and funds for wedding, funerals and emergency assistance. Our attention is also given to provide comfortable and safe work environment for employees to enjoy balance of life and work as well as physical and mental development.

- To maintain a smooth communication channel with banks, creditors, consumers, suppliers and other parties related to the interests of KGI, and to respect and protect their due rights and interests.

- To set up a communication channel for employees and encourage them to have direct communication with managerial level so as to express their opinions on corporate management, financial status or material decisions about employee interests..

- To pay close attention to issues on consumer rights, community environmental protection, public welfare and social corporate responsibility while maintaining regular business development and maximizing the benefits for the investors.

- To regularly and irregularly file/submit, in accordance with the laws, information of business operation and finance to Market Observation Post System.

- To insist in adopting clear and timely communication methods so as to fully disclose the most transparent information about operation and financial status to all investors.

CHIEF CORPORATE GOVERNANCE OFFICER

The Secretariat is directly under the Board of Directors and staffed by a competent and appropriate number of corporate governance personnel to be responsible for relevant corporate governance affairs. The Company passed a resolution on 21 August 2020 to appoint Executive Vice President Huiwen Chang as the Chief Corporate Governance Officer effective from 1 September 2020, who is qualified as she has more than 10 years of experience in legal and corporate governance affairs.

THE KEY FUNCTIONS OF THE CORPORATE GOVERNANCE AFFAIRS INCLUDE

1. Handling matters relating to board meetings and shareholders meetings according to laws.

2. Producing minutes of board meetings and shareholders meetings.

3. Assisting in onboarding and continuous development of directors.

4. Furnishing information required for business execution by directors.

5. Assisting directors with legal compliance.

6. Other matters set out in the articles of corporation or contracts.

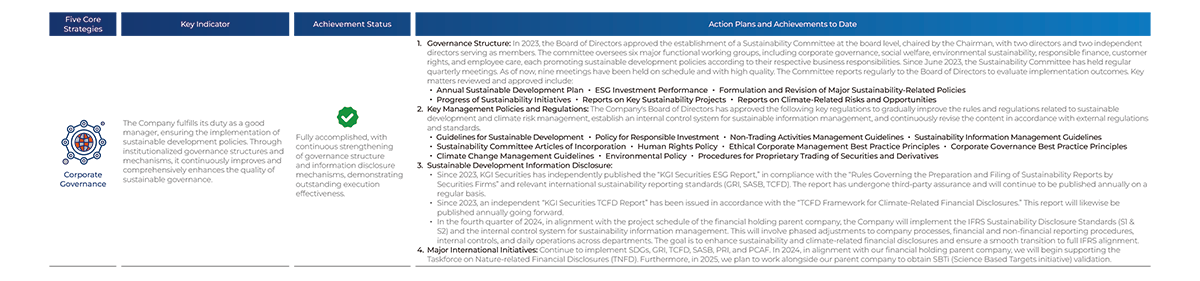

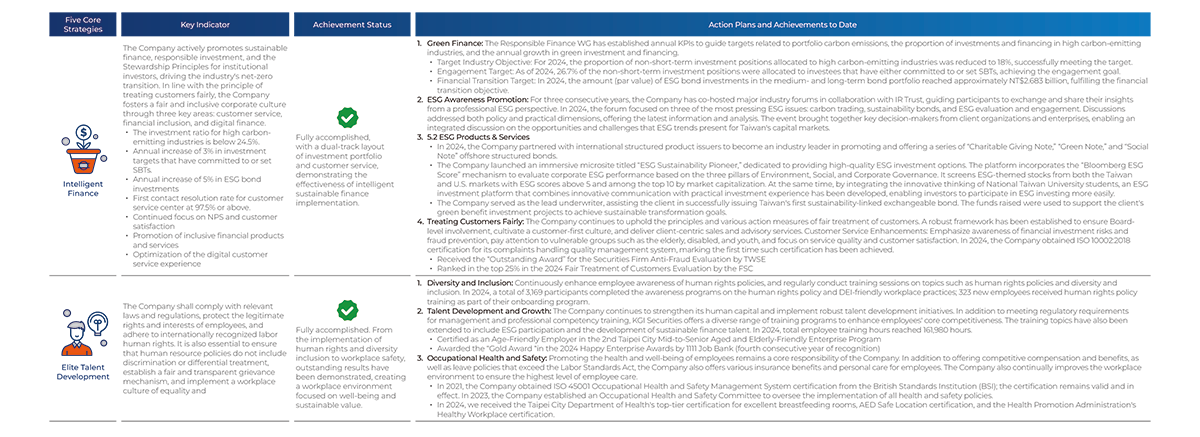

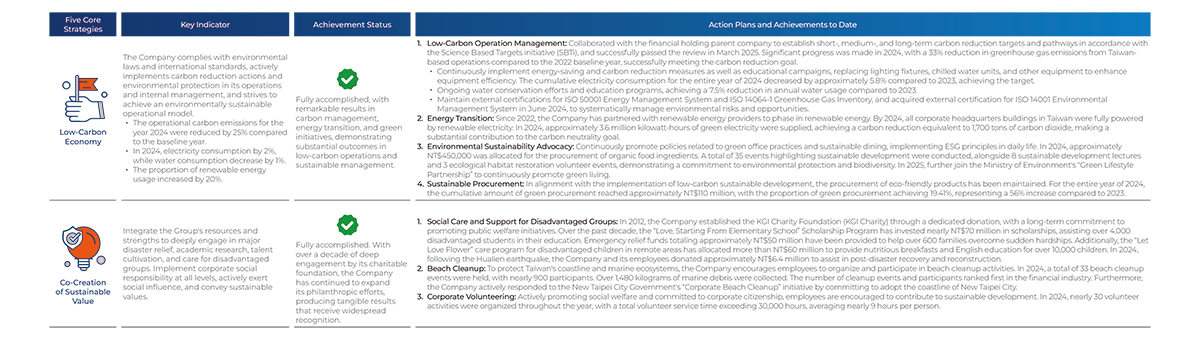

Sustainability

The Company actively implements “Green Finance,” the “Implementation Strategy for the Sustainable Development of the Securities and Futures Companies,” and other sustainability finance related policies, in alignment with the KGI Financial Group's five core ESG strategies: “Corporate Governance,” “Intelligent Finance,” “Elite Talent Development,” “Low-Carbon Economy,” and “Co-creating Sustainable Value.” The “Guidelines for Sustainable Development” have been established, committing KGI Financial to actively implement sustainable development in the course of business operations to align with global trends. Through our role as a responsible corporate citizen, we aim to contribute to the national economy, enhance the quality of life for employees, communities, and society, and cultivate a competitive edge rooted in sustainability. The Company has also engaged external experts to conduct risk analyses and assessments related to sustainability, ESG, and climate change. Together, we develop relevant policies and response strategies. To ensure transparency, we disclose our progress through the publication of ESG Reports and TCFD Reports, enabling stakeholders tomonitor KGI Securities' sustainable development. Our ESG achievements to date are summarized as follows: